- Administrator

- Alternative proteins, climate change, commodity process, Insect proteins, plant proteins, protein hunger

- 0

Global protein demand: Pressure from a healthy and wealthy population that continues to grow

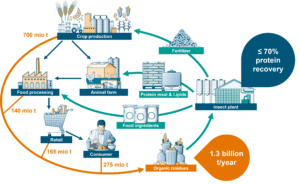

A growing global population, combined with factors such as changing socio-demographics, will place increased pressure on the world’s resources to provide not only more but also different types of food. Increased demand for animal-based protein is expected to have a negative environmental impact, generating greenhouse gas emissions, requiring more water and more land.

UN figures projecting global population growth of almost 50% since 2000 to 9.5 billion by 2050. In addition to giving rise to an increased demand for food because of more mouths to feed, other changes, such as increased incomes and urbanization, will result in changes in consumption patterns. Thus, not only will the amount of food required change, but the type of foods also demanded, and their relative contribution to diets, will change. Projected demand for protein is of particular interest, with projections that the world demand for animal-derived protein will double by 2050, resulting in concerns for sustainability and food security.

This is compounded by the fact that increased demand for animal-based protein is expected to intensify pressure on land due to the need to produce more animal feed. This in turn will increase the conversion of forests, wetlands, and natural grasslands into agricultural lands, which in itself has negative consequences for GHG emissions, biodiversity and other important ecosystem services.

In addition to increased demand arising from population growth, increased demand for protein globally is driven by socio-economic changes such as rising incomes, increased urbanisation, and aging populations whereby the contribution of protein to healthy aging is increasingly recognised, and recognition of the role of protein in a healthy diet.

Wealthier, healthier population demand for proteins

While the global population growth rate is expected to fall from 1.1% to 0.9% by 2027, the world population continues to grow by 74 million people per year, according to OECD-FAO. As such, to meet a growing society’s ‘hunger’ for meat and fish, production will continue to increase. Fish production will rise from 174 MT to 195 MT (metric tons), with an average growth of 1.1%.

Total global livestock production is expected to reach around 366 million tonnes by 2027. This includes ‘fifth-quarter’ materials (skin, bone, hooves, blood, offal, et cetera), equivalent to up to 50% of livestock weight, which is unsuitable for human needs due to regulatory requirements. This ‘fifth-quarter’ however is an important raw material source in pet food.

A wide range of stakeholders, including R&D experts, consumers, investors, and UN sustainability initiatives, are driving alternative protein development. Whilst diverse in nature – including plant based, algal, bacterial, and cultured ‘lab meat’ – they share the common aim of optimising scarce resources like land and water.

While offering many potential advantages, such as sustainability, health and wellbeing benefits, alternative proteins do not appeal to all consumers and pet parents. For some consumers, particularly millennials and Generation Z (born in 1981 onwards), alternative proteins are interesting based on their curiosity to try new things and health and sustainability benefits.

Insect farming as a sustainable source of proteins

Entomophagy (eating insects as food) is widespread, notably in Southeast Asia, and the key to successful implementations of alternative proteins, like insects, is to focus on the nutritional benefits.

Insects for example deliver a similar nutrient profile to other protein sources in both human and animal diets. They therefore have the potential for successful adoption as a novel, alternative protein source to replace existing protein sources in pet food manufacturing.

As consumers increasingly focus on sustainability and use of natural resources, connecting it to what they eat and even to what their pets eat, they are open to alternatives to animal-based proteins. And where the almighty consumer dollar goes, so go dollars from other entities.

Of the US$3.1 billion in investment capital in alternative proteins in 2020, most lay in plant-based proteins, at US$2.1 billion. Yet two other categories, fermentation and cultivated, are catching up, at US$590 million and US$360 million, respectively. The figure for cultivated proteins represented growth of six times the previous year’s investment. A perhaps more recognizable name in the cultivation protein category is Memphis Meats, which attracted US$186 million in investment, the largest funding round for that category in 2020.

Currently vegetal sources of protein dominate protein supply globally (57%), with meat (18%), dairy (10%), fish and shellfish (6%) and other animal products (9%) making up the remainder (Van Eenennaam & Werth (2021)).

Post-COVID-19, more people own pets and the demand for “humanised” petfood increases. This brings an even higher pressure on protein availability and cost.

We must save the planet while feeding ourselves quality and healthy food. Alternative proteins from plants, fermentation and insect sources hold the key to satisfying the demand for a quality protein-rich diet.

Source: https://www.oecd.org/publications/oecd-fao-agricultural-outlook-19991142.htm